Client Case Study: Diversifying Concentrated Stock Before Leaving California

The Situation

Sarah is a single tax filer earning $500,000 annually who works for a large tech company. With the flexibility to work remotely, she's planning to leave California for Texas in about a year, while continuing with her current employer. Her financial picture includes:

Approximately $2 million in highly appreciated company stock

Ongoing RSU vesting during her transition period

Annual charitable giving of around $25,000

Her primary concern? She's become acutely aware of the concentration risk in her employer's stock and wants to diversify out of 75-80% of her company holdings, but she's uncertain about the best approach.

The (1) Worst; (2) Better; and (3) Optimal Ways to do it

I see too many case studies saying "this is what we did." While we will do that (e.g. #3 the Optimal way), I want to illustrate the poor and suboptimal way I have seen other individuals approach the situation. So let's explore each of the three, from the most costly to the most strategic.

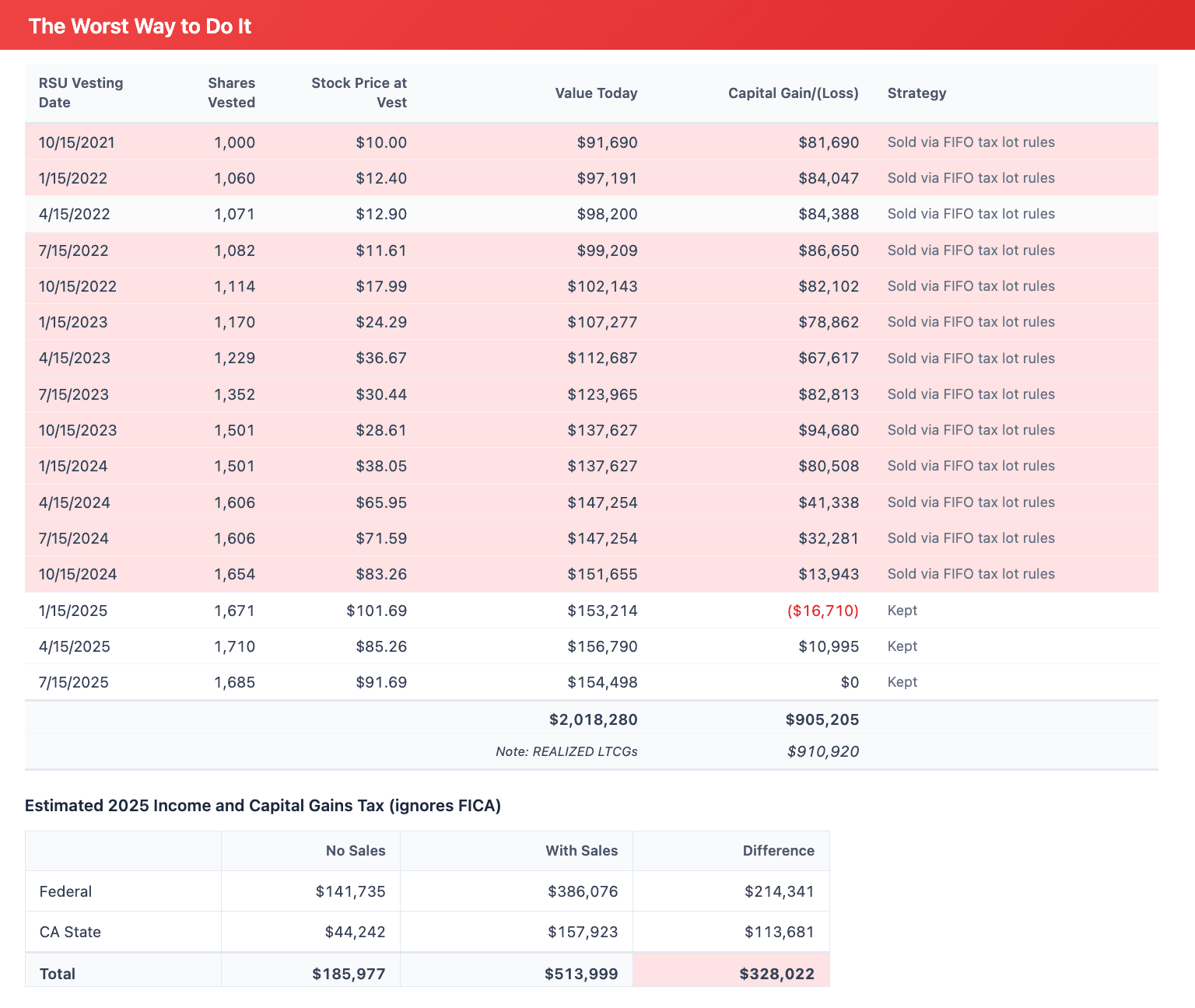

Path 1: The Worst Way to Do It

Sarah makes a common but costly mistake. She either assumes taxes will be roughly the same regardless of her approach, or she believes what some coworkers told her: “you need to hold your RSUs for one year to get preferential tax treatment.” And she simply opens her brokerage account, which defaults to first-in, first-out (FIFO) tax lot selection, and sells all her shares that she’s held at least a year.

The impact:

Diversified 16,946 of her 22,012 shares (77%)

$328,000 paid in taxes

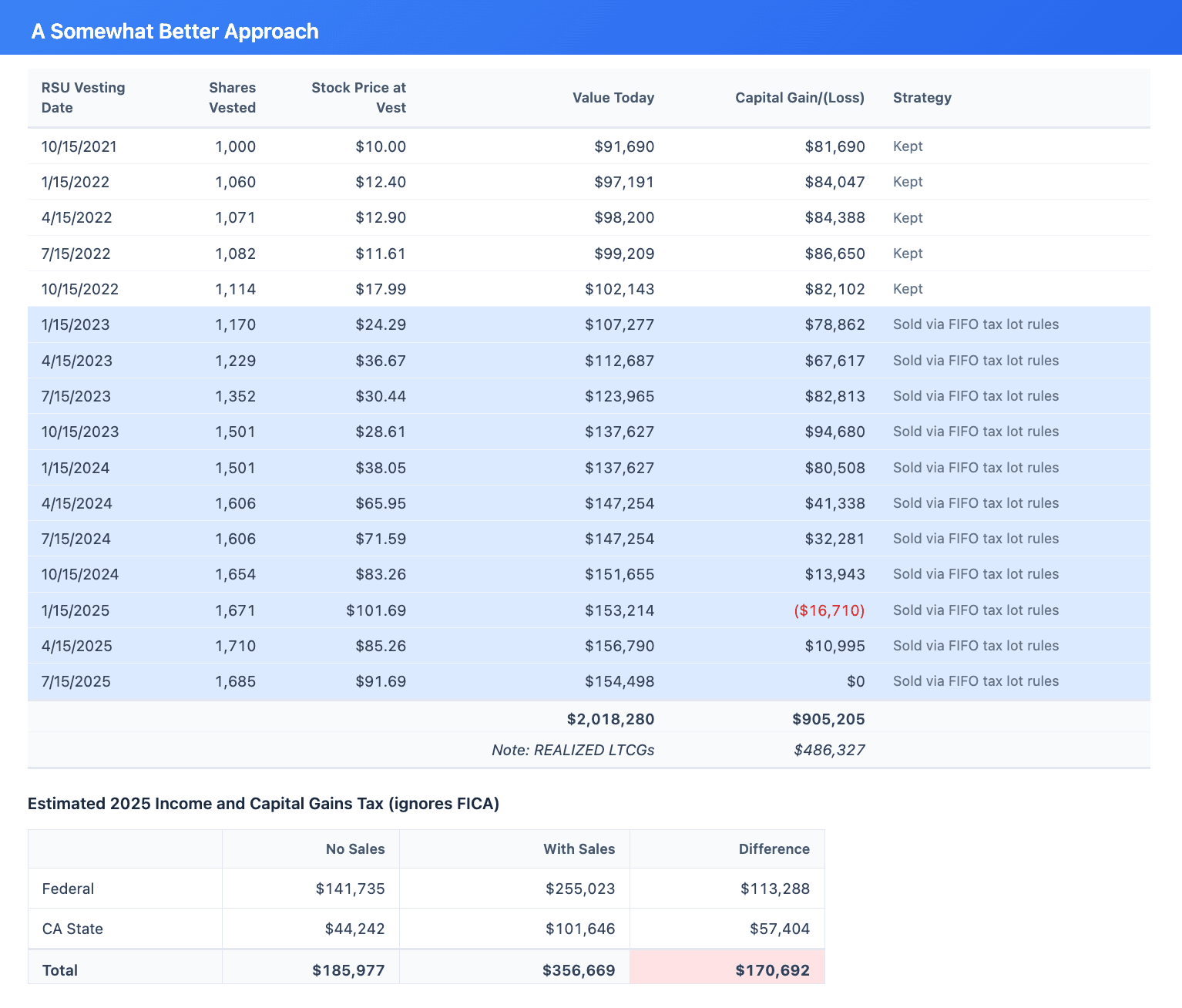

Path 2: A Somewhat Better Approach

In this scenario, Sarah understands tax lots and recognizes that the one-year holding period advice her coworkers share doesn't tell the full story. When she goes to sell, she selects specific lots rather than accepting the default FIFO method, choosing her shares in a tax-optimized way.

The results are notably better. After selling, she ends up retaining about the same number of shares (5,327 versus 5,066 in the first approach), but realizes far fewer long-term capital gains—$486,000 versus $910,000. This strategic selection significantly reduces her tax bill compared to the first path.

The impact:

Diversified 16,685 of her 22,012 shares (76%)

$171,000 paid in taxes (48% less tax than "Worst" scenario)

Path 3: The Strategic Approach

Sarah works with an advisor who helps her understand the full menu of diversification options, taking into account her life plans and priorities, including her charitable giving.

Together, they employ a multi-strategy approach that allows her to diversify with minimal near-term tax impact, and longer-term defer some taxes to future years when she'll be living in Texas and benefit from significantly lower state tax rates.

Step One: Tax-Loss Harvesting (Offsetting Gains with Losses)

They begin by examining the cost basis of her holdings and discover an opportunity. Nearly 10,000 shares can be sold with minimal or no tax impact:

Approximately 6,700 shares have such a low realized gain (only about $8,000 in long-term capital gains in total) that they can be sold with virtually no tax consequence

Another ~3,200 shares would generate gains of approximately $74,000

But...when reviewing Sarah's investment portfolio outside of her company stock, they identify positions with taxable losses totaling $80,000.

By strategically selling these positions and reinvesting in different (but similar) assets, they harvest $80k in losses that completely offset the gains from selling the additional 3,200 company shares

Step Two: Amplifying Charitable Giving (Higher Donations at Lower Cost)

Next, they discuss Sarah's charitable intentions. She's been giving around $25,000 per year in cash to charities she supports. Her advisor suggests a more tax-efficient approach: donating ,060 of her most highly appreciated company shares directly to a donor-advised fund (DAF).

This strategy provides three significant advantages:

Sarah avoids paying any capital gains taxes on those appreciated shares—a substantial benefit compared to donating cash

She still receives the full $188,000 as a charitable deduction on her taxes

The $188,000 is now available to invest and grow tax-free within the DAF, allowing her to distribute more than her target $25,000 annually to charities for many years to come

Step Three: Tax-Free Exchanges (Diversify Now, Pay Taxes Later)

For additional diversification without immediate tax consequences, they utilize two specialized exchange strategies that allow her to defer taxes until she's a Texas resident:

351 Exchange: Sarah contributes ~2,150 shares of stock (worth $200,000) along with $600,000 oh highly appreciated ETFs from her personal investment portfolio to participate in a 351 exchange for a newly launched ETF. The investment strategy aligns with her portfolio goals, and the 351 exchange allows her to diversify these holdings while deferring the tax liability to a future date.

Exchange Fund: ~3,500 shares are placed into an exchange fund. While this option is less diversified than a 351 exchange and requires a seven-year holding period, it still provides significant diversification compared to holding concentrated company stock while deferring the tax obligation.

Step Four: Strategic Retention (Avoid Immediate Tax Costs/California Tax)

With the remaining ~4,350 shares, Sarah opts to hold them for now. She may choose to sell these after relocating to Texas, where she'll benefit from the absence of California's state income tax.

The impact:

$0 long-term capital gains tax, and a charitable deduction of $188,000, which materially lowers her overall tax bill for the year.

Diversified 17,658 of her 22012 shares (80%)

The Bottom Line

The strategic approach allowed Sarah to divest ~80% of her company holdings (exactly what she was hoping to achieve), which was slightly more than the first and second paths——but with over $328,000 in tax savings compared to Path 1 and over $171,000 in tax savings compared to Path 2.

Important Disclaimer: This article intentionally simplifies certain tax nuances—particularly around charitable giving and deferred capital gains. The core ideas are powerful, but often misunderstood, and we aimed for simplification to encourage understanding versus detailing all the nuance. Key areas where additional details matter include:

Cash donations provide a tax break, and Sarah will not get those in future years if she donates a lot mor this year into a DAF. The DAF is still likely much better due to also avoiding the LTCGs on the donation, but the lack of future cash donations does matter.

Deferring gains through exchange funds allows for continued tax-deferred growth, and the freedom to realize gains later when rates may be lower, such as no California state tax. But the taxes that were deferred still eventually need to be paid when the shares are sold for a gain

Article Last Updated: October 22, 2025