Leaving Money on the Table: The Logic Behind 2025's IPO Underpricing

If you've been following the IPO market in 2025, you've probably noticed something unusual: many newly public companies are experiencing massive "pops" in their price. Figma soared 250%-plus on their debut, Circle jumped by more than 500%, and CoreWeave gained 200%-plus since going public. US IPOs jumped in first-day trading by over 20% (median), and the class of 2025 IPOs that raised more than $50 million delivered returns exceeding 40%.

This level of systematic underpricing is noteworthy, and suggests something different is happening in the market. What we're witnessing is a coordinated strategy where all market participants—companies, VCs, and investment banks—are aligned around getting deals done, even at the cost of leaving money on the table. Here is the key info you need to know:

The Last 4 Years IPO Drought

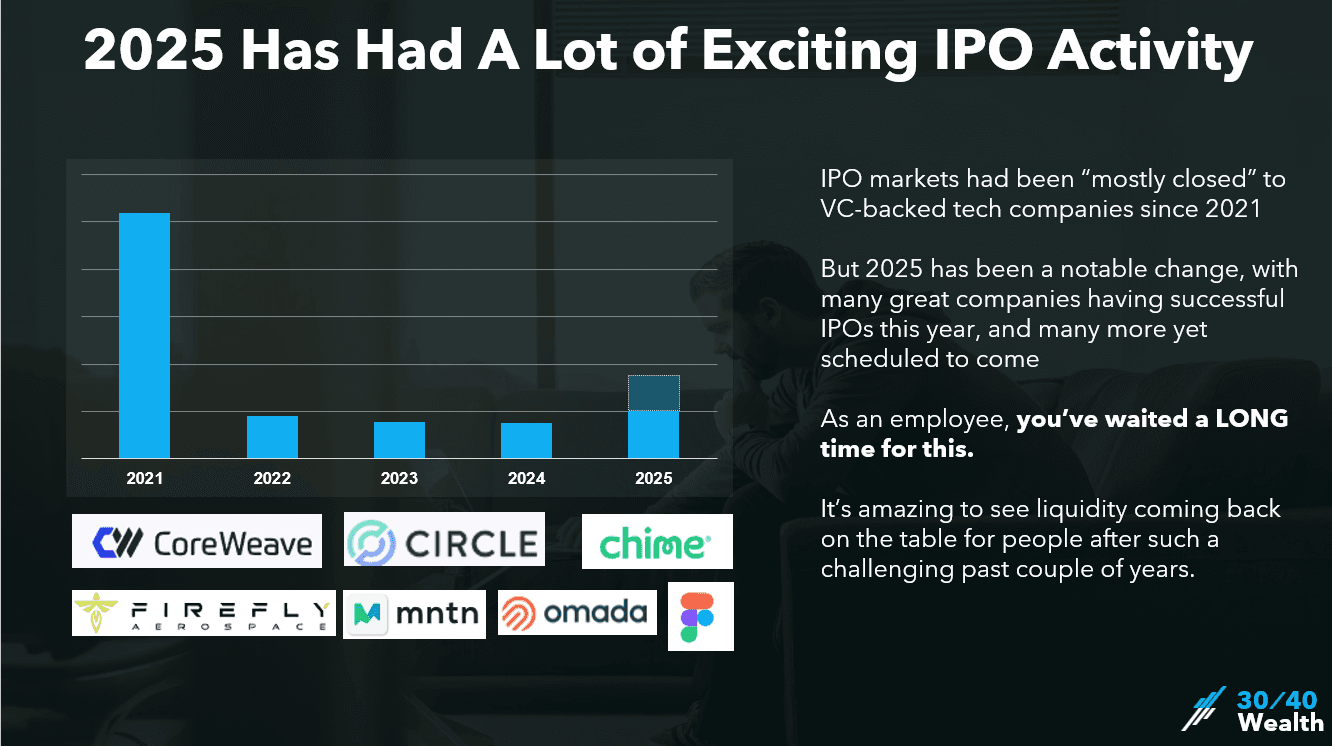

The IPO market experienced a boom in 2021, followed by a sharp downturn in 2022, and continued low activity in 2023-2024. Companies have ridden out three years of severely constrained IPO activity.

But in 2025—> We’re seeing a significant rebound: proceeds raised year-to-date have already surpassed the full year figures for 2022/2023/2024. However, the market remains semi-open rather than fully accessible. Companies still face uncertainty about timing, heightened scrutiny on fundamentals, and selective investor appetite compared to historical norms. This partial reopening creates urgency among market participants to capitalize on current conditions while they last.

Companies are Choosing Access Over Optimization

Current trends suggest that after being locked out for three years, companies find the strategic value of being public exceeds the cost of conservative pricing. This is driven by a number of variables, most significantly:

It washes their VC-pref out of their cap table and provides them with liquidity

Raising additional capital becomes significantly easier (an overnight secondary offering)

Stock can be used as a currency for acquisitions

Public status signals credibility to customers and partners, and typically allows them to more readily attract talent

The VC Liquidity Problem

The venture capital industry is facing a challenging liquidity problem. The average time to exit is now 14 years, and ~40% of unicorns have spent 9+ years in portfolios - which means VCs are sitting on the >$1 trillion value of those companies combined. This creates pressure throughout the system:

VCs struggle to return capital to limited partners, which in turn makes LPs reluctant to commit to new funds

Without fresh capital commitments, VCs can't invest in new companies or support existing portfolio companies that need follow-on funding

This dynamic is encouraging VCs to prioritize getting portfolio companies public. Even if the initial IPO pricing isn't favorable, they only sell a small percentage of their holdings. Once public, the market decides the company's true valuation (which is what matters most to the VCs and their LPs).

Investment Banks and Market Momentum

Investment banks derive significant revenue from dealmaking, creating strong incentives for increased IPO volume. Each successful IPO with strong first-day performance signals to other potential issuers that market conditions are favorable, generating momentum for additional offerings.

The Huge Question: Is It Sustainable?

A big question many are asking: will this pseudo-intentional underpricing create a self-sustaining IPO market, or does it represent a temporary adaptation to unusual conditions?

Thus far, the strategy is proving effective. The Renaissance IPO ETF has posted a return of nearly 50% since April, close to doubling the S&P 500's return. This strong performance validates this approach and creates a self-reinforcing cycle—successful IPOs generate investor appetite for more IPOs, encouraging additional companies to go public. Said another way:

Companies are happy right now

Employees are happy right now

VCs are happy right now

Public Company investors are happy right now

But.... whether this approach will (1) continue to persist, (2) if pricing will normalize but IPO activity remains robust, or (3) if things will falter....is still to be determined.

If I were to guess, we will stay with this dynamic through at least the end of 2025. Thereafter, my bet is on normalized pricing with a "relatively open" IPO market (vs. "mostly closed" in 2022/23/24). But it's what everyone is watching, and only time will tell.

Article Last Updated: September 9, 2025