Betting Big on Company Stock? Here's a SMART Way To Do It

If you work at a public tech company and more than half your wealth is tied up in your employer’s stock, you’re not alone — and you’re not necessarily wrong.

There's a frequently quoted saying:

Concentration builds wealth; diversification preserves it

But having a concentrated position doesn’t mean you have to start selling and diversifying right away. You certainly can, and many do; in my experience working with clients who have concentrated stock wealth, about 80% focus on the preservation side of that equation.

But that means 20% opt to continue holding for more upside — and not a lot is written about how to do that in a SMART way. This article is for you! Below we detail the key steps we work on with clients to develop a plan for holding a concentrated position for additional upside.

1. Ensure You Plan For the Downside (if Things Don't Work Out)

Talk to any hedge fund manager — and most would tell you that every good investment strategy starts with risk management. Being right all the time is impossible. In fact, the top hedge fund investors are only "right" about 52-55% of the time. They plan on being "wrong" a lot!

That's OK — and how their business works. It means they focus considerable time + have a plan in place for how/when to exit, hedge, or otherwise risk manage an investment when it isn't a winner.

The same principle applies here. Before you decide to intentionally hold a concentrated stock position, make sure you've fully considered the financial impact, and qualify-of-life reduction that would occur if things don't work out.

And per the below, make sure you have a plan in place for what actions you will take if things go well, and if they don't.

2. Thoroughly Research Your Company as an Investment

Keeping a large amount of company stock as an investment is a high risk, high reward decision. If you're "betting" 6- or 7-figures on a company stock (or contextualized differently, 5 to 10+ years worth of salary), you need to have a very well researched reason, with high conviction.

Simply working at the company doesn't cover it. At this size of an investment, you should have thoroughly researched the company growth rates and levers for how that increases/decreases, company valuation ratios (and how they compare to peers), insight into key catalysts that the stock market isn't anticipating that will bolster the company price, and more. 100 hours minimum!

If 100 hours sounds like a lot, well in some ways it is. But if you're investment size is 5 years of salary, then 100 hours is less than 1% of the years of salary you financial have at stake (2.5 weeks / 260 weeks)

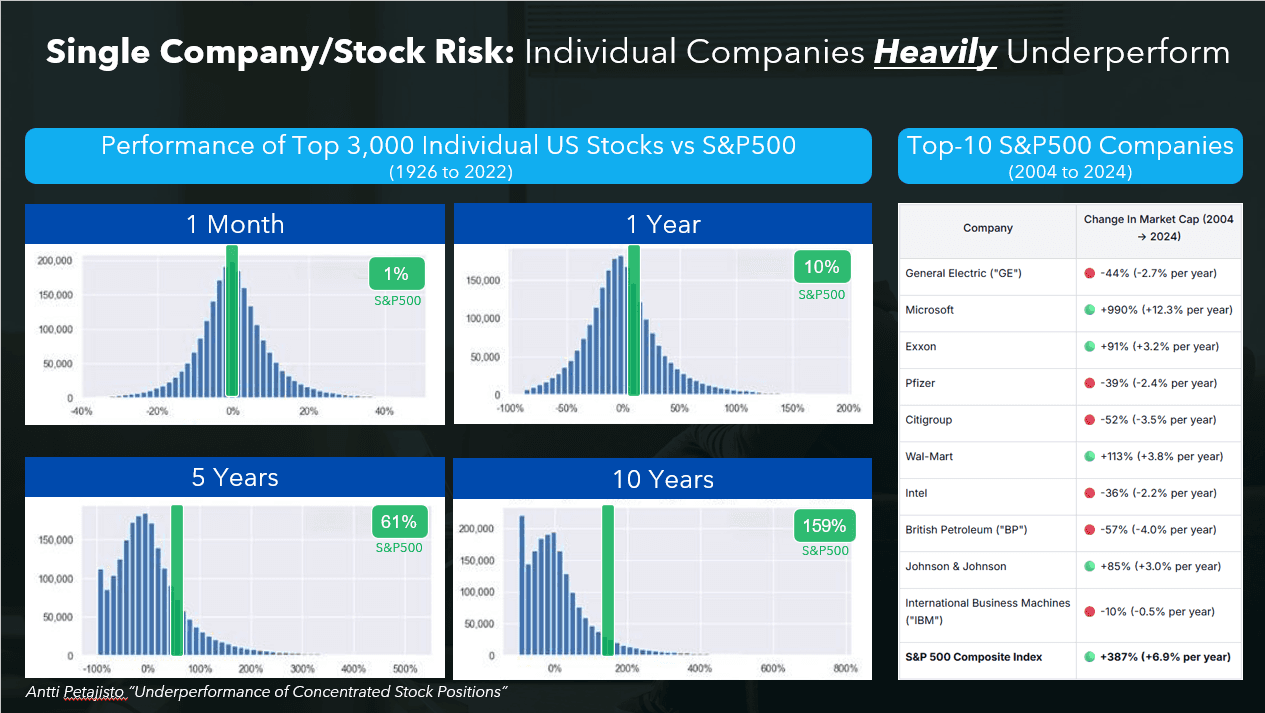

The reason why is two fold. (1) You're betting a TON of your own money, and (2) The odds are heavily against you. A sobering statistic:

Recent research says that over a 10-year period, more than 95% of individual companies underperformed the S&P 500

For this to work out really well for you — you need to be one of the sub-5% minority whose stock does amazing. It definitely happens; I've seen it multiple times! But your bet is large, and the odds are against you. So you need to have really done comprehensive investment and market research to know WHY you believe the company will do materially better than what the market already expects it to.

3. Create a Plan (For Upside and Downside)

One of the most highly correlated items I have seen with disappointing outcomes: not having a plan. That's largely because the one thing we know with 100% certainty is that things will change.

Change is fine. And normal. But your plan has to be able take into account that things will change -- that your investment thesis will be proven right or wrong over time — and ensure that you take actions to capitalize (e.g. sell a portion) when your upside case hits, or protect yourself (e.g. sell or hedge) if things don't work out as hoped.

There are many ways to develop a plan; but the most important = list out your expectations and what you will do if/when they occur (or don't).

An Example:

Let's say the stock is priced at $50.00 a share right now, and you own 40 shares ($2 million position). You've done your research, and believe the stock has significant upside primarily due to a new product launch (which you dont think Wall Street is taking into account, and you believe will increase revenue growth rates by 10% over the next 18 months).

You have (presumably) a well-researched investment thesis, and there is a timeline for the catalyst. Now, what's your plan for your investment position if/when:

The product launch is delayed (or never occurs)?

The product launch occurs but fails to deliver the growth you expected?

You're right, and the stock doubles in 12 months?

Most plans fail because the only "plan" was "I'm going to hold my stock". When you have huge stakes on the line, you need to go well beyond that. You need to have a detailed reason for why you believe the stock is undervalued (relative to the markets expectations), and what you will do once the events/catalysts that you expect to occur transpire (for better or worse).

Or at a minimum, you need to have a plan based on price points.

If you believe the stock is going to double...then what are you selling when it doubles?

If the stock is flat over two years...is your investment thesis wrong? And if so, how much should you sell?

If the stock falls by 30%; 50%....are you selling then to protect some of your investment?

A planning framework is below that I use for my clients — it's highly adaptable to both (1) those who want to sell a lot (or all) rapidly, and (2) those who want to hold a solid chunk long-term. It's simple, but also powerful. And the framework works whether you're wildly bullish or just cautiously optimistic — providing a glidepath for your equity, rather than a cliff + ensuring you create a plan versus just winging it.

4. Be Tax-Smart (But Prioritize Investment Dynamics First)

When you're managing a large single-stock position, the investment risk/decisions are the top priority. But....every decision also has tax impact. And smart tax planning can add 3-4% to your net worth many times (and more than 25% in edge cases). A few items to consider are:

Optimize for Long-Term Capital Gains, QSBS, and State Taxes. Ensuring your sales are taxed at favorable long-term capital gains rates can provided a 17% benefit or more

ISOs and AMT Planning. Timing ISO exercises against your AMT exposure can save you tens or hundreds of thousands

Strategize across ISOs and NSOs. More NSO income expands the amount of AMT income you can incur without resulting in an AMT tax bill

Manage your tax bracket. If you have a lot of NSOs, but also a lot of time — make sure you plan wisely for your NSO exercises across years to pay income taxes at a lower bracket rate (e.g. 24% vs. 37%)

Charitable Donations. Donating appreciated stock is a tax-efficient way to reduce concentration and make an impact if you're charitably inclined

5. Install Self-Checkpoints

Plans change. All...the...time. Holding a concentrated position requires a higher level of time investment, ongoing research, and re-validation of your investment thesis.

Because the stock prices, company financials, business strategy, and economic/political environment change daily — you should have regular check-ins to revisit your plan:

What did you expect to happen?

Did it happen?

How has the company (and your outlook) changed?

Document your thesis. Write it down like you’re advising a friend. For example:

“I’m holding 30% of my net worth in stock because I believe revenue will double in the next 2 years. If leadership changes or growth flatlines, I will reduce my position by half.”

These checkpoints turn emotion into data — and protect you from blind spots.

Final Thought

Holding a concentrated stock position is a lot of work. But if you can afford to do it, want to do it, and believe in the position — it has the possibility to be hugely rewarding. And also not.

So plan for the upside, and the downside, and revisit that plan often.

In the words of the Mandalorians "This is the Way"

Article Last Updated: September 29, 2025