How to Borrow at Rates Below 4% AND with Tax Benefits

Today we dive into box spread for borrowing -- which can be pretty compelling in the right situation. The two key benefits of borrowing via box spreads are:

The ability to borrow at a fixed rate below 4% up to ~5 years

The "interest" on the loan has big tax benefits --> treated as a capital loss, which you can use for tax loss harvesting

For individuals with tech wealth, borrowing via box spreads can be very beneficial in the right circumstances. A few situations I've analyzed with clients include:

You need cash (e.g. to buy a home), but do not want to sell your highly appreciated stock. You can desire not to sell for tax and/or investment reasons

You have a higher-rate mortgage on your home. If you bought in the last few years, your interest rate is likely 6% or higher

You have a mortgage above $750k on your home. Mortgage interest on your home is tax-deductible, but only up to $750k, then the tax benefits stop

Borrowing via box spreads is not available or appropriate for everyone. It's a loan collateralized against your investment portfolio, so you (i) need a sizeable investment portfolio, and (ii) must be comfortable with the risk of borrowing against it. But in the right situation, it can save you a lot of money, especially after tax.

What Is a Box Spread and How Does It Work as a Loan?

A box spread is an options trading strategy. You sell/buy a combination of four option contracts on the same underlying asset (typically the S&P 500 index, or SPX) with the same expiration date but different strike prices (e.g. 5000 and 6000). For example, a box spread setup to borrow could look like:

Short (sell) 5000-strike Call option on SPX

Short (sell) 6000-strike Put option on SPX

Long (buy) 5000-strike Put option on SPX

Long (buy) 6000-strike Call option on SPX

Depending on how you set it up, you can use the box spread to either (i) invest capital targeted at making a return roughly inline with US Treasuries, or (ii) borrow at a rate roughly inline with US Treasuries.

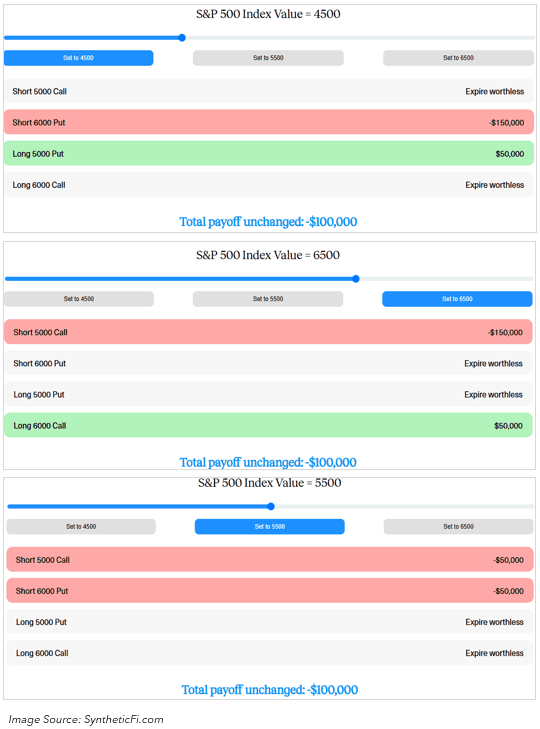

When you combine these positions, something interesting happens: market risk predominately disappears. The four options create a "box" in which the payoff becomes fixed and guaranteed, regardless of where the market goes. For example, lets look at the payoffs in three different scenarios for the SPX:

They are transacted at a discount; interest rate is built in. If done on the SPX (recommended), these trade in $100,000 notional units. And you buy/sell the combined box spread as a discount. For example, if you sold a box spread that expires in 1-year, and the implied interest rate is 4%, then you would get ~$96k today, and owe $100k in 1 year when it expires.

The key difference from a traditional loan or Margin or SBLOC: Instead of a bank or your broker lending you money--which carry much higher rates--you're accessing liquidity directly from the options market. For the SPX, thousands of institutional participants use this to borrow or earn interest nears the federal funds rate. And with box spreads, you can too.

The Compelling Advantages of Box Spread Loans

Interest Rates Below 4%

The most immediate appeal of box spreads is the cost. Current rates on box spread loans typically range from 3.75% to 5.0% depending on the duration. This compares to other securities-backed lending options like Margin or SBLOCs that typically range from 5.5% to 13%. When you're borrowing six or seven figures, even a 2-3 percentage point difference translates to thousands or tens of thousands of dollars in annual savings.

Fully Tax-Deductible "Interest" with No Limits

This is the big second benefit of box spreads--and also a feature many people overlook or misunderstand.

When you borrow via a mortgage, only the interest on the first $750,000 is tax deductible

Nearly all personal loans are not tax deductible

But in investment markets: (1) interest on borrowing is deductible with no limit, and (2) there is also no limit on utilizing capital losses to offset gains

The details: Because box spreads are preferably setup via options on a broad-based index like SPX, they fall under Section 1256 of the tax code. In tax geek terms, this has a couple of impacts:

Mark to market. Section 1256 is required to be "marked to market", which means instead of capital gains/losses occurring when you sell, the security is marked to a market price each year and the gain/loss for that year is taxable

60% of gain/loss is long-term; 40% is short-term. Section 1256 contracts specify that any marked-to-market gain/loss is split in this manner

What this means for you if you use box spread borrowing

When you sell a box spread to borrow, you get the discounted cash that day. At the end of each year, the position is marked to fair value, and the loss is reported on your taxes for the year. For example:

You sell a 2yr box spread on the SPX with 4% implied interest on 1/1/23. You get $92,500 that day

At EOY 2023, it would be marked to market value of ~$96,150

You'd have a realized ~$3650 capital loss in 2023; 60% ($2190) would be a long-term capital loss and 40% ($1460) would be a short-term capital loss

Repeat similar math for 2024

Those capital losses can offset gains you have in your portfolio. For someone in a high tax bracket (say, 37% federal plus 10% state), the tax savings from these capital losses used via tax-loss-harvesting could be worth additional 1.1% in tax savings (i.e. 6.5% mortgage rate that is not tax deductible vs. 4% box spread + 1.1% of tax benefit = 3.6% implied after tax savings).

No Principal Repayment Required

Box spread loans don't require you to make monthly principal payments. You can structure the loan to simply owe a fixed amount at expiration—anywhere from a few months to five years out. If you want to pay down or refinance early, you can close out the position, though this introduces some interest rate risk (more on this below). You also have the flexibility to "roll" the loan by closing one box spread and opening another with a later expiration.

The Risks and Downsides You Need to Understand

Box spreads sound almost too good to be true, which means it's crucial to understand the risks. These are real, and they can be significant if you're not careful or if market conditions turn against you.

(1) Margin Call Risk

This is the big one. When you use a box spread loan, you're using your investment portfolio as collateral, similar to any securities-backed loan. If your portfolio value drops significantly, you could face a margin call—meaning you'd need to either add more cash, add more securities, or have your broker liquidate positions to meet the requirement.

I encourage my clients to mitigate this risk by not exceeding more than 25% of the portfolio value in borrowing.

(2) Interest Rate Risk When Refinancing

When you enter a box spread, you lock in a rate for the duration of the options. If at expiration you desire/need to borrow funds (i.e. do not desire to pay it off fully)—you'll need to do so at the prevailing interest rates at that future date. This is called interest rate risk.

(3) Other Important Considerations

Execution complexity: Box spreads involve simultaneously trading four option legs, and bid-ask spreads can be wide. You need either significant options trading experience or you need to work with a specialized provider.

STRONGLY Encourage "European" option type vs. "American" type. While a box spread can technically be done with most securities that have put/call options, it is strongly recommended that they are built with "European" type options. These do not allow the option holder to exercise early, while the "American" type does--which creates a big monitoring and price risk dynamic.

Limited broker support: Not all brokers fully support box spread strategies, and you'll generally need a margin-enabled account with highest-level options approval.

Minimum loan sizes: Sometimes this can be done with ~$10k units, but the $100k unit of SPX is preferred.

Tax complexity: You'll need a tax professional familiar with Section 1256 contracts and mark-to-market taxation.

The Bottom Line

Box spread loans can offer a compelling combination of sub-4% interest rates and significant tax benefits. They are definitely not right for everyone. But in the right situations, the combined savings can be significant

Article Last Updated: November 21, 2025