The RSU Tax Withholding Dilemma: 22% vs 37% (And Why Your Choice Matters More Than You Think)

TL;DR: If you're facing a double-trigger RSU vesting at IPO and your company is giving you the choice between 22% and 37% tax withholding, this decision is essentially asking you: "Do you want to gamble on your company's post-IPO stock performance while potentially owing a massive tax bill, or do you want to play it safe and 'sell' more shares at the IPO price?" There's no universally right answer, but there's definitely a wrong way to think about it.

Picture this: You've been grinding at your startup for three years, watching your RSU grant sit there like a lottery ticket you can't scratch. Then boom; IPO announcement! Suddenly, everyone's talking about "double-trigger vesting" and "tax withholding elections," and you're staring at a form asking whether you want 22% or 37% of your shares withheld for taxes.

If this sounds familiar, welcome to one of the most consequential financial decisions you didn't know you'd have to make. And honestly? Most people get it wrong because they're thinking about it all wrong (or don't think about it much at all).

Do You Even Get This Choice? (Spoiler: Not Everyone Does)

First things first: this choice isn't universal. Companies CAN offer employees the choice, but they dont HAVE to. Some companies make their lives easier, only withholding 22% (the IRS requirement), and call it a day.

So why do some companies offer the choice? It's actually pretty straightforward: they recognize that the mandatory 22% withholding rate is going to leave most of their employees massively under-withheld, and they'd rather give people the option to handle their taxes properly than deal with a bunch of panicked employees come April.

Essentially, companies that offer the choice are saying, "We know you're about to have a tax problem. Here's a tool to fix it." Companies that don't offer it are basically saying, "Good luck, figure it out yourself."

The FACTS: WHAT and WHY This Occurs (And Catches Everyone Off Guard)

The IRS has a rule about certain types of income and required tax withholding. Basically, RSUs are considered "supplemental" income, just like bonuses. And the IRS requires withholding only 22% for supplemental income (up until $1 million; then 37% above that). The problem arises when the RSU income pushes you into a higher marginal tax bracket.

Let's break this down with some real numbers. Say you're a single tax filer making $300,000 in salary (congrats, by the way), your company IPOs, and your double-trigger RSUs vest for a value of $350,000. That extra income jumped your tax brackets, with the incremental $350,000 pretty much all having a 35% federal tax rate applied; not the 22% your company withheld. And the math gets ugly fast:

Incremental RSU income: $350,000

Tax withheld at 22%: $77,000

Actual tax owed at 35%: $122,500

Your surprise tax bill: $45,500

The Hidden Decision: You're Actually Choosing How Much to "Sell" at IPO

Here's the reframe that changes everything: This isn't really a tax withholding decision—it's an investment decision disguised as a tax choice.

When you choose 22% withholding, you're essentially saying:

Underpaying taxes. I'm intentionally underpaying my taxes, and know I will owe a large tax bill come April.

Hold excess company stock. I want to hold as many shares of my company as possible (even though I already own a lot), as I strongly believe my company stock will rise significantly in the first 6 months (the typical lockup period during which you cannot sell).

When you choose 37% withholding, you're saying:

Fully pay taxes. I want to have my taxes fully paid up (with refund potential) come April.

Sell more/diversify company stock. I want to 'sell' more shares at the IPO price to cover my taxes and reduce my exposure to the company's future performance (as I already own a lot, which I cannot sell until after the lockup anyways).

The Decision Framework: When 22% Makes Sense vs. When 37% Wins

Choose 22% Withholding When ALL of These Apply:

You're very bullish on your company's post-IPO prospects and think the stock will be significantly higher when lockup expires

You have cash reserves to cover the likely tax shortfall (plan for 10-15% more than what's withheld)

You're comfortable with concentrated risk in your company's stock

The IPO happens early in the year, giving you time to sell shares and pay taxes before April 15th

Choose 37% Withholding When ANY of These Apply:

You're nervous about post-IPO performance or want to lock in gains at the IPO price

You don't have cash to cover a potential large tax bill

You prefer diversification over trying to time the market

The IPO happens late in the year, creating a cash flow crunch between tax obligations and lockup expiration

Real-World Scenarios: When Your Choice Really Matters

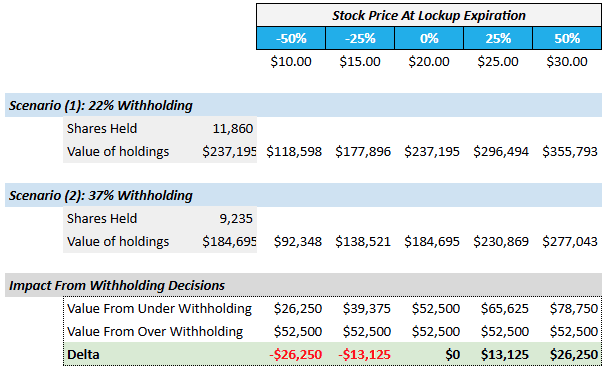

Let's look at some concrete examples using an incremental $350,000 RSU vesting, assuming your average tax rate for the year will be 30%:

Scenario 1: Stock Up 25% at Lockup Expiration

22% Withholding: You keep 11,860 shares, now worth $296,494 vs. the $237,195 they were worth at IPO. You're ahead by $59,299.

37% Withholding: You kept 9,235 shares, now worth $230,869 vs. $184,695 at IPO. You're ahead by $46,174.

22% wins by $13,125 (but you still owe that tax bill)

Scenario 2: Stock Down 50% at Lockup Expiration

22% Withholding: Your 11,860 shares are now worth $118,598 vs. $237,195 at IPO. You're down $118,597.

37% Withholding: Your 9,235 shares are worth $92,348 vs. $184,695 at IPO. You're down $92,347.

37% wins by $26,250 (and you're not facing a huge tax bill on devalued shares)

The math is pretty clear: if the stock goes up significantly, 22% wins. If it goes down, 37% wins. The question is: do you feel lucky?

The Horror Stories: When Things Go Very Wrong

The "December IPO, April Tax Bill" Nightmare

Imagine your company IPOs in December, your RSUs vest, you elect 22% withholding, and then you're locked up until June. Come April, you owe $45,000 in taxes, but you can't sell a single share. You're stuck scrambling for cash or paying penalties and interest to the IRS.

The "Stock Crash" Special

Remember Blue Apron? Their stock fell over 90% from their IPO price. If you had elected 22% withholding, not only would your remaining shares be worth almost nothing, but you'd still owe thousands in taxes based on the much higher IPO price. It's like paying income tax on Monopoly money.

Pro Tips for Either Choice

If You Choose 22%:

Immediately set aside cash equal to 15-20% of your RSU value for the tax bill

Consider increasing your paycheck withholding or making quarterly estimates

Have a backup plan if the stock tanks before you can sell

If You Choose 37%:

Accept that you're "selling" shares at IPO price and don't look back if the stock moons

Focus on what you can do with the diversified proceeds

Remember that avoiding a worst-case scenario is often worth missing some upside

The Bottom Line

This decision boils down to a simple question: Are you willing to bet thousands of dollars on your company's post-IPO stock performance while risking a potentially massive tax bill?

In my experience, about 80% of folks opt for the 37% choice -- driven by (1) the desire not have a huge tax bill, and (2) not taking on even more company concentration risk (as they already will have a ton with the RSUs they need to hold until lockup expiration).

Either way, just don't make this decision in a vacuum. Talk to a CPA, run the numbers, and remember that sometimes the boring choice is the smart choice. After all, you've already won the startup lottery by getting to this point—don't blow it by getting too clever with the exit strategy.

One final thought: Whatever you choose, stick with it and don't second-guess yourself when you see how the stock performs afterward. You made the best decision you could with the information you had at the time. That's all anyone can do—even the professionals who do this for a living sometimes get it wrong.

The tax landscape is complex and everyone's situation is different. This article is for educational purposes and you should definitely consult with a qualified tax professional before making your decision.

Article Last Updated: September 9, 2025