What Happens To Your Stock Options When Your Company Is Acquired?

When your company is acquired, the outcome for your equity compensation can vary significantly. We wish we were able to say “this is what is very likely what is going to happen to your options, and these are the key actions you need to take”.....but alas, like most things in stock-based-compensation, the devil is in the details.

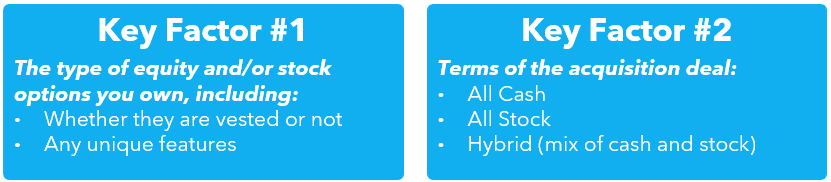

We dive into those below, but at a high level, there are 2 key factors that will determine most of what is going to happen to your holdings:

Key Factor 1: The Type of Equity and/or Stock Options You Own; Vested or Unvested; and Unique Features

There are a number of stockholders and stakeholders in a company, and an acquisition is a complex undertaking. Determining what will happen for your ownership holding(s) depends a lot on the type of ownership/exposure you have:

Shares of common stock. If you’ve exercised a vested stock options (e.g. an NSO or ISO), you own shares of stock in the company. In most situations, the acquiring company will need to purchase these shares from you pursuant to the terms of the acquisition (cash, stock, or mix).

Vested stock options (ISOs or NSOs). If at least a portion of your stock options are vested, you have the right to buy shares in your company. As such, the acquiring company (in most cases) will need to compensate you for this right/value (otherwise you would exercise the right and purchase shares—and then they would need to buyout your shares). Acquirers typically handle this in a couple ways:

(i) Buyout your stock options (net of the strike price)

(ii) Substitute or assume your stock options for equivalent value in their company

NOTE: The amount you will receive will depend on a number of factors, include your grants strike price, the buyout price, and buyout terms. For any vested options that are "underwater" (i.e. the buyout price per share is below your option strike price), it does not have any value and they will likely be canceled as well.

Vested restricted stock (RSUs). Vested RSUs are treated very similar to vested stock options. You have vested into the restricted stock, and the acquiring firm in most cases will need to compensate you for it.

Unvested stock options (ISOs or NSOs) and RSUs. This is typically the trickiest one. Unvested options or RSUs, by definition, are unearned and thus have no explicit value. Because of that, the decision for what to do with these employee holdings is mostly up to the acquiring company to decide. We’ve seen lots of different approaches, but the most common are:

Cancel the grant. The acquiring firm could choose to cancel all, or a portion, of the grants unvested shares/units — functionally providing you with no compensation at all for them.

Assume or substitute the grant. In this scenario, the acquiring company would provide you an updated or substitute grant. They could potentially assume the grant (updated to reflect equity in the acquiring company, with a conversion ratio), or they could issue a new substitute grant (again, specific to the acquiring company's equity) with similar terms. The implementation and tax considerations vary depending on the specifics.

Accelerate and/or cash out the grant; either partially or fully. The acquiring firm could accelerate the grant (i.e. make all unvested shares vested), or opt to provide some form of compensation (cash or shares) for the unvested portion of your grant. Note that an acceleration or cash out could be partial or full.

Keep the grant as is and pay out a cash bonus as it vests. The acquiring firm could allow the structure of the grants to persist, and when an RSU vesting event occurs, make a cash payment to you (requisite to the value of the shares vesting).

Unique features (accelerated vesting). In less common cases, stock-comp awards can have what is known as a “single trigger” or “double trigger” feature (or in some cases, a company's stock option plan could require acceleration for all grants in an acquisition). An acceleration requirement means that if certain criteria are met, all unvested shares will immediately vest (single trigger = accelerate upon acquisition; double trigger = accelerate upon acquisition and loss of job). If your grant(s) contain this feature, it could materially change the compensation you will receive.

Key Factor 2: The Terms of the Acquisition Deal

Acquisition deals are typically one of three forms: All Cash; All Stock; or Hybrid (a mix of cash and stock). While the names are largely self-explanatory, the impact that the deal structure can have on your stock-based-comp is material:

All Cash. In this case, the acquiring firm is utilizing cash on its balance sheet to purchase 100% of your company. The value you will receive (per share) if/when the acquisition is completed is set and should not change. It also frequently means that all stock holdings in your company will need to be sold (triggering capital gains or losses).

All Stock. In this case, the stock you own in your current company is exchanged for a similar value of stock in the acquiring company, utilizing an exchange ratio (e.g. 0.47 shares of your company stock = 1 share of the acquiring company stock). Because you will be receiving stock—and the value of stock can change frequently (e.g. publicly traded companies stock changes daily)—the value (in dollars) you will ultimately have in the acquiring company's stock when the deal closes can/will vary. Last, a "stock for stock" acquisition usually does not create a taxable event (but not always)—which can have a material impact for ISOs and stock you're planning to claim as Qualified Small Business Stock ("QSBS") tax exemption when you sell.

Hybrid. In this case, the buyout is paid in a combination of cash and stock (and thus it has elements of both of the above) at a prespecified ratio. For example, if a deal is a 50% cash; 50% stock deal—the cash component would be set/not change, and the 50% stock component would have an exchange ratio (with the value of the stock component subject to market variation).

Most Common Outcomes

Sounding like a broken record, each acquisition deal is unique, as are your holdings, vesting, and exercise history (if applicable). That said, we believe it's helpful to try to provide some generalized guidance regarding the most common outcomes (while disclaiming that they may not apply to your situation).

Deal Structure | Stock | Vested Options/RSUs | Unvested Options/RSUs | Tax Impact(s)* |

|---|---|---|---|---|

All Cash | You're paid cash for the shares you own (price is fixed) | Most commonly bought out for cash | Most typically not paid for. May be indirectly compensated in other ways (e.g. retention grants in Acquiring Co.) | Cash paid for shares is likely a "sale" and will trigger capital gains (or losses). The buyout of options or RSUs is most likely to be treated as income* |

All Stock | An exchange ratio is determined and you effectively swap your company shares for the acquiring company's | Varies. Vested grants are commonly paid for, but the choice of cash, stock, or a mix varies | Most typically not paid for. May be indirectly compensated in other ways (e.g. retention grants in Acquiring Co.) | Most (but not all) stock-for-stock deals do not create a taxable event. The tax treatment for the buyout of options or RSUs depends on how it's done* |

Hybrid (Mix of Cash and Stock) | The percent cash and percent stock is set (e.g. 50:50). Each works like detailed above, respectively | Most likely you will receive a mix of cash and stock identical to the ratio for stock | Most typically not paid for. May be indirectly compensated in other ways (e.g. retention grants in Acquiring Co.) | Detailed above. Cash likely triggers a sale and capital gain or loss. Stock-for-stock is not a taxable event in most situations. Option or RSU buyouts depend on how it's done.* |

Key Strategies & Financial Planning Items To Consider

Because each deal is unique. the key strategies, financial planning items, and tax optimizations to consider (if any) will depend on both (i) the specific deal terms, and (ii) your individual holdings. That said, we’ve detailed below a number of financial planning strategies and tax optimizations that may apply in certain situations. We recommend you speak with your financial and/or tax advisor before implementing any of the below.

Achieving holding period requirements for ISOs and/or Qualified Small Business Stock ("QSBS"). Both ISOs and/or stock investments planned to claim QSBS have required holding time requirements. The type of acquisition and/or how the acquiring company opts to treat certain employee equity grants are likely to impact whether or not the ISO and/or intended QSBS stock will meet their required holding period. Potential tax savings: up to 24%*

If the acquiring company is publicly traded—you will have liquidity for your shares and should create a divestment plan. Being acquired by a publicly traded company offers the ability to sell shares periodically. The new equity you have in the acquiring company likely comprises a material amount of your net worth (especially in All Stock and Hybrid deals). When you have a concentrated position in a publicly traded company, it's important to develop a thoughtful selling plan for your holdings—balancing risk and reward, as well as seeking to minimize the tax impact.

Read 30-40 Wealth's approach to creating "no regrets" selling plans

Key planning benefits: reduce concentration risk + optimize for tax

You may be able to avoid paying FICA taxes if you have ISOs in a All Cash deal (or the cash portion of a Hybrid deal); but it comes with some risk. ISO stock options have a couple unique tax attributes, one of which is that ISO disqualifying dispositions are exempt from FICA taxes (currently 6.2% Social Security + 1.45% Medicare + possible additional 0.9% Medicare tax). But if an ISOs grant is bought out (i.e. when the deal closes), it's considered a cancelation of the grant for tax purposes (vs. a disqualifying disposition) and FICA taxes do apply. The prospective strategy is to exercise your ISOs prior to the deal closing to avoid/save on FICA taxes, but to also be aware of the risk that if the deal fails to close, you can't undo that purchase. Potential tax savings: 1.5% to 7.5%*

You may need to make estimated tax payments (or be subject to penalties and fees). Certain events that can occur during a merger—such as an ISO disqualifying disposition and/or capital gains—typically do not require tax withholding. But you will of course still need to pay the taxes on the income/gains. The IRS has rules for if/when you need to make estimated tax payments, as do most states. You want to make sure that you understand the rules for each, and make estimated tax payments if necessary to avoid costly underpayment penalties and fees. Potential benefit: 0.5% per month savings (by avoiding fees)*

Consider tax-loss harvesting and investing in Opportunity Zones to defer or reduce capital gains taxes. An acquisition can result in a material capital gains, and thus also material capital gains taxes (federally, as well as in most states). There are some strategies that you may way to consider utilizing to defer or reduce your capital gains taxes—such as tax-loss-harvesting and investing in Opportunity Zones. Potential tax savings: up to 24%*

If you were intending to exclude taxes via a QSBS claim and the merger impacted your strategy (unable to hold for the required 5 years), you may consider a QSBS 1045 exchange. A 1045 exchange allows an individual to reinvest some, or all, of a gain that would otherwise have been recognized on the sale of QSBS-eligible shares into shares of a different qualified small business (e.g. "Replacement QSBS") on a pre-tax basis. The timelines, rules, accounting, and processes for doing this can be tricky, but successful implementation could materially reduce your tax bill. Potential tax savings: up to 24%*

If the acquisition will result in you having an atypically large income for a tax year, you may consider strategies to maximize your deductions. Atypically large income tax years likely increase your marginal tax rate (vs. more normal years). To reduce the tax burden, you may consider strategies that maximize tax deductions in the same year, such as:

Maxing out 401k and/or IRA contributions (and your spouse if married filing jointly)

Stacking deductions in the year (e.g. contributing multiple years of planned charitable contributions to a Donor Advised Fund in the year of the acquisition)

Potential tax savings: up to 50% in select situations*

Things That Could Go Wrong (At Least For You)

In the majority of acquisitions, the deal proceeds largely inline with the timeline and financial terms that were announced. But in 10-20% of deals things change. Beyond that, there are a number of other items that can materially effect how much, and when, you get your cash. Below we detail some things that we believe are important to be cognizant when developing your plan.

The acquisition deal terms can change, or the acquisition could be canceled outright. Deal’s that are announced (but not closed) are always subject to change. Shareholders may fail to approve the deal, regulatory bodies may not allow the deal to happen, or the acquiring firm may learn something during diligence that makes them renegotiate or cancel the deal. According to McKinsey & Company, around 10% of “large” acquisition deals fail to close, and that number rises to ~17% when the deal structure is a hybrid cash and stock deal.

If you’re company is sold for a lower valuation than most expected, you may get nothing at all. When VC firms invest in your company, they (almost always) get preferred shares—which as the name implies, have preferred rights vs common shares. Moreover, VC's preferred shares also frequently include “liquidation preference” clauses. In plain English this means:

VC’s preferred shares have contractual language that stipulates in an acquisition, they will get back a multiple of the money they’ve invested before anyone else sees a dime. Market standard in Silicon Valley is 1.0x, but higher/lower ratios are possible.

Example: Your company raised $250m of VC money, and is ultimately acquired for $200m. If the VC’s have a 1.0x liquidation preference, then the VCs will get all $200m ($200/$250 = 0.8x; below the 1x requirement). Common stock holders, including founders and employees will not see a dime.

If you’re options are underwater (i.e. buyout price < strike price) when your company is acquired, they have no value and will likely be canceled (including vested options). When company valuations decline, the price per share of the company could become below the strike price of the options (this is known as being "underwater"). If this occurs, your options, including vested options, are likely to be canceled and you will get no value/compensation for them.

Example: Jenny joined UnicornCo in January 2021 and received 30,000 NSO options with a strike price of $6.00 per share. In October 2022 her company is acquired for $5.00 per share. Her options are underwater, and it's likely all of her options (vested and unvested) will be canceled (i.e. Jenny will not receive a dime for them).

New and/or replacement grants you get from the acquiring company may have more onerous vesting timelines. While some jobs may be at risk in an acquisition (due to redundant roles), others are not—and the acquiring firm will want to ensure you are incentivized to stay. One way they may try to do that is by modifying vesting schedules for your new stock comp grants to include cliffs and/or back-end weighted vesting.

A portion of the cash or stock may be held in escrow (likely to be paid to you in the future, but not always). In some acquisitions, a portion of the funds to be paid for the purchase will be held in escrow. This is done to help the acquiring company protect against certain risks (e.g. litigation) for a period of time. If a risk event occurs, it may reduce or eliminate the funds you were to receive out of escrow. If no risk even occurs—these funds are typically paid out within 6-24 months.

You may become restricted in exercising your stock options (especially if your company is publicly traded). If your firm is going to be acquired, those involved in the deal will seek to keep it secret—but it can be challenging to do that. To protect against insider trading, your firm may restrict some, or all, employees from exercising their stock options for a period of time (e.g. until the deal is publicly announced).

Early exercised stock options via 83(b) election that are not vested are likely to be repurchased. Early exercising stock grants via an 83(b) election can be a viable tax strategy, but it very likely won't change how your ownership is treated in a merger. As noted above, the most typical treatment of unvested grants in a merger is to cancel them. While you technically own shares (vs options) due to an 83(b) election—your company retains the right to repurchase the unvested shares. If the acquiring firm opts to cancel unvested stock options, it's extremely likely the unvested portion of the shares you bought via 83(b) will be repurchased.

Article Last Updated: May 27, 2025