How to Convince Yourself to Sell Your Company Stock (Even When It Feels Wrong)

Deciding how much company stock to sell is one of the hardest decisions to make objectively, and is one of the topics that comes up most with my clients. Psychological biases cloud judgment when it comes to valuing your company's stock, making it difficult to think clearly about what's best for your financial future. In this article we’ll discuss what you need to be aware of to help you rationally work through this decision, so you can best meet your financial goals.

Let's Start With Identifying The Problem: WHY is it so Hard to Decide To Sell?

In short, you've been conditioned over time with a lot of biases. Most individuals have a positive affinity for their employers (else they seek jobs elsewhere). But when you work in tech -- it's amplified. A passion for the problem(s) your company is helping solve is typically a requirement.

And there is typically a lot of cheerleading and celebrating if/as you solve them and grow (sometimes very rapidly). Especially when you create new technology, software, or services. You were PERSONALLY involved in helping to build and grow the company!

And the value you got from all that effort building the company-- it's your equity. Which means for many, it holds a special place in your mind. And selling it can feel like you're de-valuing your hard work.

That feeling you have -- its a mix of Association Bias, The Endowment Effect, and The Anchoring Effect. Combined, they can be powerful motivators to keep holding onto company stock, even if you know it's not your best choice:

Association bias is the tendency to overvalue something because it’s linked to your personal identity. When you’ve helped build or grow a company, the stock becomes symbolic of your work and accomplishments. That emotional connection makes it feel harder to sell, even when it’s the rational choice.

The endowment effect is a behavioral bias where people value an item more highly once they own it. Employees over-value their shares simply because they already own them—particularly early employees who helped build the company and struggle to separate their emotional investment (i.e. blood/sweat/tears) from the stock's true financial value.

The anchoring effect causes people to rely too heavily on initial information when making decisions. If the company has 10x'd before and is still growing, it must still be a great investment, right?

So What Can You Do? How do you OVERCOME a Psychological Predisposition, and Make a Rational Decision?

This is the key focus. Below, we will give you the data for why most people should opt to sell (the data is compelling). But mentally overcoming a predisposition to not sell can be hard. In our experience helping individuals overcome this, a few tools and frameworks have been really beneficial to employ:

(1) Regret minimization

Ask yourself: "Which outcome would make you regret more?"

You sell 100% of your shares today, and over the next few years the stock price triples, or

You don't sell any shares today, and over the next few years the stock price declines by more than 90%

Breaking the problem down this way into only two choices (though you have many more than that) helps you narrow in on what's most important to you and make a choice aligned with your values and risk tolerance.

(2) Reframe your company stock as any other investment

Think about what decision you'd make if the value wasn't tied to your company:

Imagine you just inherited $1 million. What are your plans for that money (save it, invest it, spend it)?

If your immediate reaction is NOT to use all the money to acquire more of your company stock, then it's likely not a good idea to maintain a concentrated position.

Your boss just gave you a cash bonus of $50k. What do you want to do with it?

Now imagine the bonus is in RSUs. Whatever you decided for the cash bonus should be exactly the same as the RSUs—even though it likely means selling the shares.

(3) Make a selling plan to keep you honest

Create a structured plan so you have a roadmap to follow instead of facing more emotional decisions down the line. Making ONE decision to sell (via a selling plan, and sticking with it) is a lot easier than making MULTIPLE decisions to sell over time. Yes -- your plan can pivot if there are true changes to company value or your financial situation. But most times that doesn't happen, and having a solid plan from the outset helps prevent irrational heat-of-the-moment decisions. For example, segment your stock into three groups:

(A) Shares to sell immediately (typically 30-100%)

(B) Shares to hold long-term (typically 0-20%)

(C) Shares to sell over time (typically 20-60%) -- which really helps balances the fear of selling too early against the fear of not selling at all.

Double-click: Sub-frameworks for the shares you sell over time

Price Averaging - sell equal amounts monthly over 12-24 months (guaranteed to hit all the highs and never sell everything at the lows)

Dollar Targeting - sell however many shares needed each month to raise a specific cash amount over 12-24 months

Limit Orders - set target prices where shares automatically sell if stock rises to your set price (never sell below your comfort level, but you risk not selling anything if the price doesn't hit your target)

Alternatively: If you decide to keep a large amount long term

While this approach is less commonly (maybe 10-20% of situations), you still need to plan if you choose this route.

Write down your investment thesis

Document why you believe the company will outperform, what needs to happen to prove you right or wrong, and

Define specific exit plans for both success and failure scenarios

Want more details: Explore this article

(4) Ask for Help

If you're still stuck despite trying these exercises, consult an expert - we're pretty good at this kinda thing :)

The MATH: Why Most People Should Opt to Sell Most/All Their Concentrated Stock Holdings

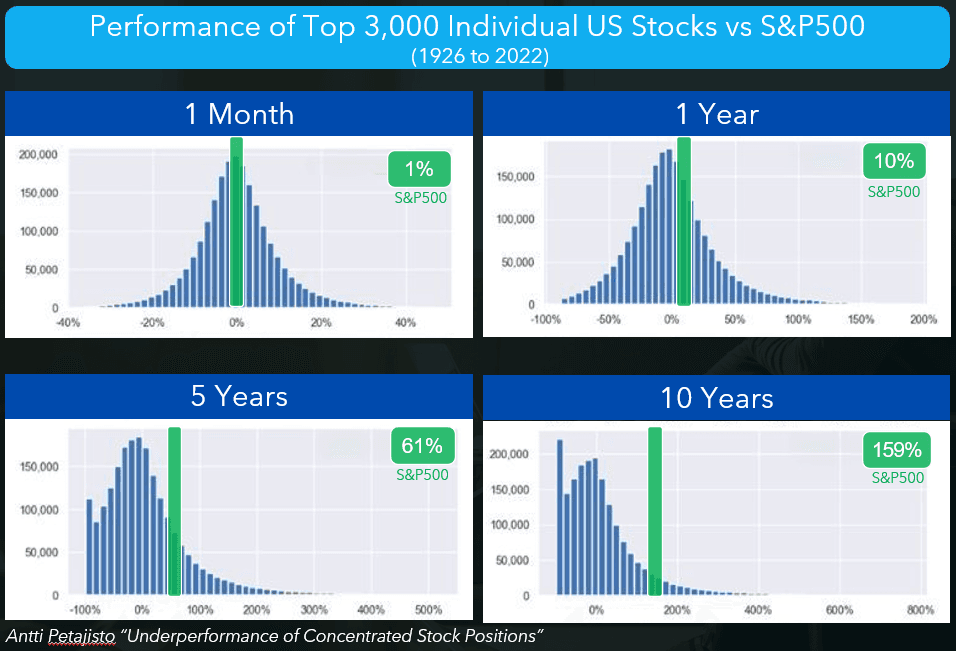

We've written about this before, so we won't jump deep into the data (but links are available below if you want to). The gist is -- holding more than 20% of your net worth in your company's stock is a statistically poor choice because the data regarding single company returns and risk is compelling.

Nearly all markets (pre-IPO, recently public, or mature S&P 500 companies) have the average return pulled up by positive outliers.

S&P 500 Returns over the last ~25 years averaged around 9.0% a year. But the median return of an individual company was around 5.0% (almost half!)

Similar data persists for the SP500 over the last century (as detailed in the image below)

And for recent IPO companies? More than 70% under-perform post-IPO

Key Takeaway

Humans don't make financial decisions purely based on data, and that's okay. But...we should be aware of what drives our decisions and thoughtfully consider our options. The goal isn't perfect decision-making; that's impossible when investment outcomes are uncertain. Rather, it's about making the best choices you can, give unknown future dynamics and the psychological factors and biases already in play.

Article Last Updated: December 10, 2025