SpaceX Employee Equity: The 5 Decisions That Matter Most in 2026 (and How to Make Them)

If you work at SpaceX, your financial life is amazing, but also weird — having over the last few years quietly crept into “this changes everything” territory. And right now, two things are true at the same time:

You may have a January 2026 tender at $421/share

There are credible rumors of a 2026 IPO that could value SpaceX dramatically higher (some chatter implies prices above $800 a share)

That combination creates opportunity…and also a lot of ways to accidentally light money on fire with taxes, liquidity mistakes, and poor sequencing.

This article is meant to do one thing: Give you a clear decision framework for the 5 moves that most SpaceX employees will face over the next 12 months — so you don’t optimize the wrong variable, at the wrong time, with the wrong shares.

I’m not here to tell you what to do. I’m here to give you the playbook I use with my clients (from SpaceX and other high-profile tech companies) so you can make intelligent decisions and reduce the possibility of regret.

The “SpaceX 12-Month Decision Map”

Over the next year, most SpaceX employees will face some version of these decisions:

January 2026 Tender offer: Should you sell in the tender or wait for the IPO?

Share selection: When you sell (in the tender, at the IPO, or after) — which shares should you sell first/second/third and why (this is where taxes are won/lost)

Option exercise: Whether (and when) to exercise ISOs/NSOs + how to plan for the AMT bill (and recoup it in future years)

IPO readiness: Lockups, blackouts, and liquidity timing (AKA: “can I sell when I want to?”)

Concentration plan: How to reduce single-stock risk without nuking your after-tax outcome

Let’s walk through each one.

Decision #1: Should you participate in the tender — or wait for the IPO?

This is not a simple “price goes up” question. It’s a risk + liquidity + life question.

The two doors

Door A: Sell some now

You reduce concentration risk

You create cash liquidity

You have more cash to fund exercises / taxes / life goals

You likely create a tax bill (unless you have offsets, which are definitely possible)

Door B: Hold for a potential IPO

You keep full upside exposure (but also the downside risk; public markets are a lot more volatile vs. when you’re private)

You may (or may not) have liquidity soon

You may face lockups/blackouts that delay selling

You may be forced to make decisions later under pressure

The framework: “Do you need to de-risk OR de-stress?”

Most people frame this as: “Will the IPO price be higher?”

That’s the wrong primary question.

Better primary questions:

What % of your net worth is SpaceX? If you’re 70–90%+ in one company, you’re heavily concentrated.

If SpaceX stock dropped materially after IPO, would your life materially change? If yes, you have a risk problem, not a return problem.

Do you need cash within 12–18 months? Home purchase, taxes, career optionality, starting a business, etc.

Can you tolerate a world where this is the last tender before IPO + lockup? Not guaranteed — but it’s a scenario you should plan for (the rumored IPO may very well negate future tender deals).

How important is it for you to de-risk your vested options by selling some stock to buy them? If you leave the company, you have a short time window to buy your vested options before they expire.

A simple mental framework I use with clients:

If selling some shares buys you freedom (liquidity + risk reduction + optionality) and doesn’t compromise your long-term goals, it’s usually worth serious consideration.

Decision #2: If you sell, which shares should you prioritize?

This is where most people “feel” their way into a decision and accidentally create a bad tax outcome. As a SpaceX employee you likely have a mix of:

Owned stock (via RSU vesting). This was already taxed as income at vest, and you own it now.

Owned stock (via ISO exercises). This was already taxed when you exercised, but you likely paid AMT and selling these shares helps you recoup AMT.

ISO options. Likely AMT at exercise, favorable tax if qualifying disposition, but have to follow the rigid rules to get there.

NSO shares. Income at exercise based on current stock price.

ESPP shares. Can be tax-efficient depending on holding period, and have been an amazing wealth builder given look-back and discount.

The “Do Not Screw This Up” order of operations

1) Avoid ISO disqualifying dispositions

SpaceX has a particularly painful ISO quirk: if part of an ISO grant becomes disqualifying, it can “taint” the grant and wipe out favorable ISO treatment.

That’s not just “oops.” That can be a lot of money. If you take nothing else from this section:

If you cashless exercise vested ISO, or sell purchased ISO shares — make sure you understand whether they are qualifying disposition shares

2) Avoid short-term gains unless you love paying extra taxes

For shares you already own (RSU stock, exercised options stock), short-term gains are usually a “why did I do that?” move.

3) When choosing among long-term shares, basis matters

All else equal, if you’re selling long-term shares, you often want to:

Sell highest-basis shares first. That will help you reduce the capital gain (and capital gains tax) recognized per share sold.

4) AMT recoup is a real lever

If you’ve paid AMT from ISO exercises in past years, selling qualifying ISO shares can be one of the cleanest ways to recoup AMT credits (and most people don’t plan around this well).

Practical summary

If you’re selling in a tender, the best choice of shares to sell is not universal — it depends on what you’re optimizing for:

Minimizing taxes this year

Recouping AMT

Preserving ISO treatment

Maximizing long-term upside

Creating cash for exercises

But the wrong choice can easily cost you 6 figures.

Decision #3: Should you exercise options (ISOs / NSOs) — and if so, which, when, and why?

This is the most technically complex decision…and the one most likely to become a mess if you wait too long.

First: the quick distinction

NSOs: exercise = ordinary income on the spread; later gains = capital gains (if price increases)

ISOs: exercise can trigger AMT; qualifying disposition can give favorable tax treatment (but you have to manage it)

The “NSO exercise” reality

For many SpaceX employees, exercising NSOs early is often not the best move because:

It requires real cash (cost to buy + triggers immediately payable income tax on the spread)

It further increases your exposure to SpaceX

There are cases where exercising NSOs earlier can convert future gains to long-term capital gains. Definitely a valid strategy to consider. But for many SpaceX folks, you have SO much exposure to SpaceX already, that the cash + risk tradeoff makes it unattractive.

The “ISO exercise” reality: AMT is the gatekeeper

At today’s prices, ISO exercises are almost assured to trigger AMT for many employees. So the decision becomes:

How much AMT will you trigger? (the tax modeling of this is complex)

Can you fund the exercise + AMT without creating a bigger problem?

How likely is it you can recoup AMT credits later?

What happens if you leave SpaceX? (post-termination time to exercise is short; may be hard to come up with the cash)

The framework I use: “Flexibility beats optimization”

It’s tempting to chase the perfect tax outcome. But with the large amount of SpaceX wealth you have, optimizing for flexibility typically trumps optimizing for “maximum theoretical after-tax IRR.” And the focus shifts to:

not getting trapped

not getting forced into a bad decision

keeping career and life flexibility

starting the ISO holding period clock (where appropriate)

Sometimes that means a “less optimal” move on paper is the best move in real life.

What that functionally means for many

Opt to sell stock (and/or tender vested NSOs) in this tender offer to raise cash

Then use that cash to exercise meaningful ISO blocks (and pay the AMT bill)

Is it a positive NPV if the $1.5 trillion IPO occurs and you can sell at that price —> probably not

But is it rational and reduces your risk in many scenarios (an IPO or otherwise) —> 100%

Decision #4: How to prepare for an IPO when you don’t control the rules

If SpaceX IPOs, you will not get to vote on:

Whether or not you as an employee can sell stock during the IPO

If there is a lockup, and presuming there is one, how long it will last

Blackout periods

10b5-1 plan eligibility timing, etc.

What to plan for (the worst-case assumption)

You cannot sell any shares in the IPO

There’s a standard lockup of 6 months after the IPO where you also cannot sell

Once the lockup expires, you can only sell shares when not in a blackout period (about 6 out of every 13 weeks in a quarter)

This is normal; and no need to panic. But advance planning around it is helpful.

Why this matters today

If this tender is your last clean liquidity window for a while, you need to consider:

Your cash needs over the next 12-18 months

Tax timing (capital gains, ISO/AMT)

Your option exercise plan over the next 12-18 months

Concentration risk/exposure to SpaceX and how you manage it

Decision #5: What’s your concentration risk + tax plan? And how will you execute it without emotion?

SpaceX is an exceptional company. And I have a number of clients who have opted to keep very significant exposure to the company long term.

But when we did that, we made sure that was an intentional choice — as it's contrary to the data. And now as an IPO approaches (at rumored high valuations), even those individuals who kept a lot of stock are focusing much more on diversification.

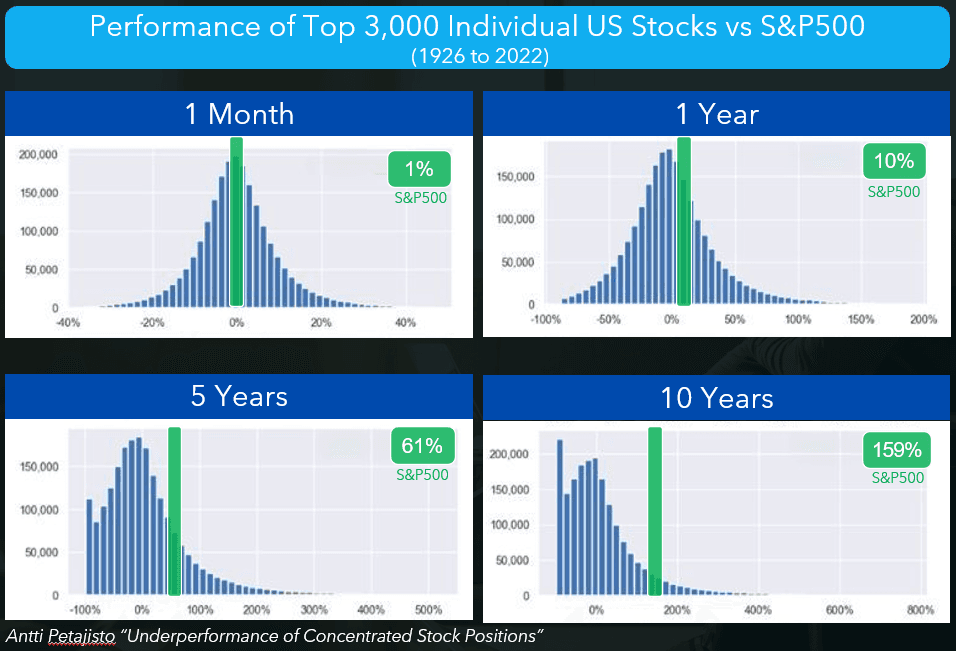

The reason is a very logical one: taking concentration risk is statistically a challenging path.

To be clear, the problem with single-stock concentration is not that it can’t work, it’s just that it's statistically unlikely it will. Most of us know that with early stage VC-backed companies, the vast majority fail, but a couple do spectacularly well, creating an attractive average return. But the median return is much less.

Same thing happens with publicly traded companies. A small minority of stocks perform so well that they pull the average up. But the median is underwhelming. This even applies with the largest companies - as detailed below, for the 10 largest companies in the SP500 in 2004, 6 of them lost money over the next 20 years, and 3 of them underperformed the SP500. Only 1 out of the 10 performed better than the SP500…

A Psychological test (”Regret Minimization”) to help you think it through:

There are two futures people regret:

Future 1: You don’t sell, and the stock drops materially

Future 2: You sell, and the stock doubles

Which regret is bigger for you? Your answer is a clue to your true risk tolerance — and should help inform how aggressively you de-risk your SpaceX holdings.

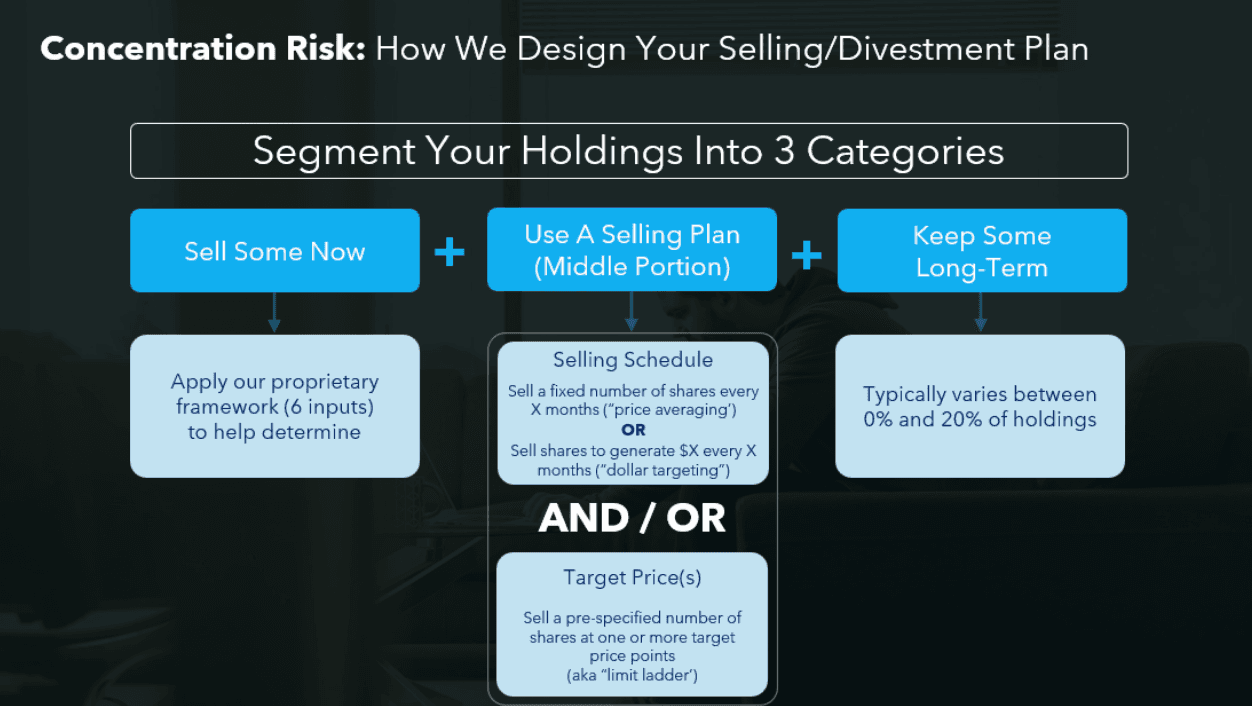

Creating a Selling Plan: The 3-bucket framework (what I use with clients)

When developing a selling plan (ignore tax-optimal ways to do this for now), I typically help clients classify shares into 3 groups:

This 3 bucket approach works for a LOT of people:

(1) We figure out how much we need to take off the table near term. This is immediate de-risking and cash generation.

(2) We chat through how much (if any) you want to keep long-term in case the stock continues to do super well.

(3) For a lot of the shares, we develop a selling plan, which typically sells shares over time. For example, by selling evenly over 3 years you would likely get roughly the average stock price over those 3 years, which many find psychologically fair.

Tax optimization comes last (on purpose); but it's still VERY important

When you think about your exposure to SpaceX, if you should sell, when, and how — the right ordering framework is:

Your Life plan / goals. Your money is in service of you and your family's life and goals. As amazing as SpaceX stock might do in the future, if there are important life dynamics you need cash for, you should sell stock to raise cash to prioritize those first.

Investment risk. Next is investment portfolio dynamics. Once you have already taken the needed cash off the table for your family and life, we want to make sure we build a risk-appropriate portfolio for you and your situation. As noted above, having a large portion of your wealth tied to a single company creates a high risk situation. Most want to avoid or minimize that risk — which you accomplish via diversification (but that is a meaty topic in and of its self, so I will pause on further details for it for now).

Tax optimization. While this is last, it's still a very important focus. Every dollar you can save or defer on taxes can help drastically increase your after-tax wealth (which is what you care about). But you want to make sure you don’t take unnecessary investment or life risk just because of the tax impact (I have more than a few people that despite the data did not want to sell stock in order to not (yet) pay the ~24% capital gains tax — and watched that stock decline by 50%+ over the next couple years).

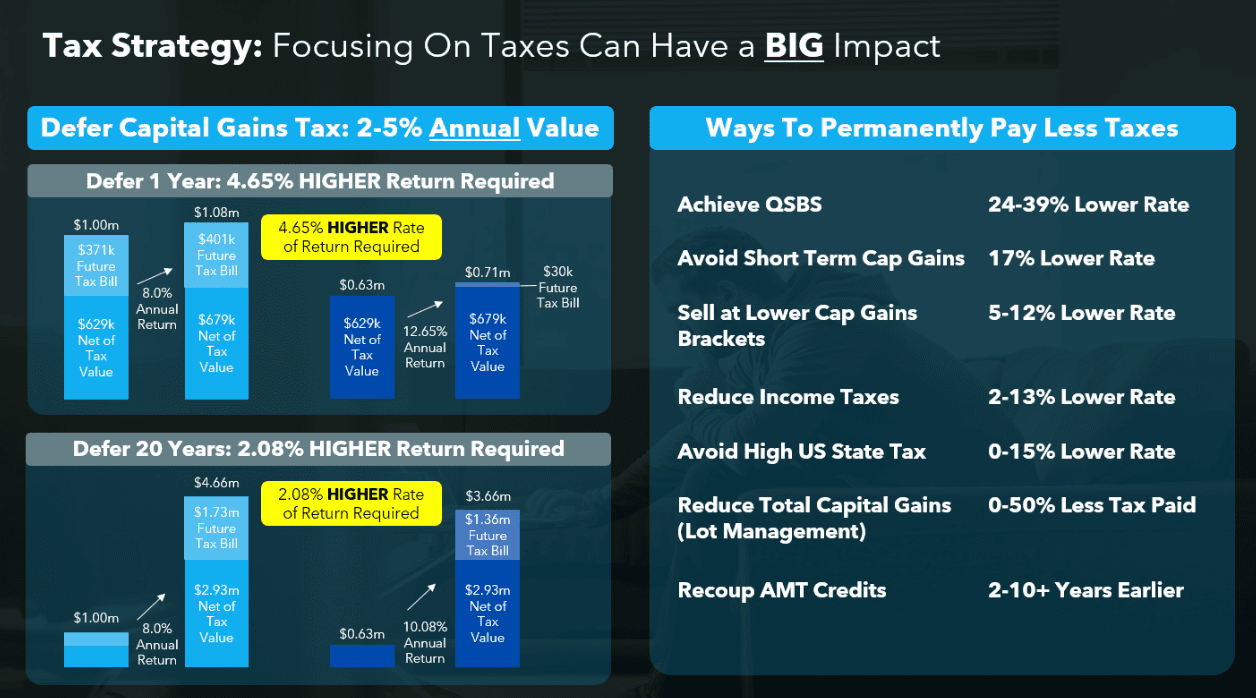

HOW you can tax optimize while still diversifying

This is also a very meaty topic. But as I have written extensively about it, I will provide a short list here, with links if you want to research further.

Charitable Giving (CRUTs; Donor Advised Funds)

As for the WHY you should be focused on taxes, short answer is a handful of tools do exist to help materially reduce the amount you owe to the IRS, which means you keep more. That’s powerful, and worth ensuring you understand and optimize for (can be worth more than 2% per year over 20+ years):

Want to know more? 45 Minute IPO and tax strategy video available

I recently recorded a ~45 minute video getting into how to think about the 6 month “blackout period” and all the choices you have. With an IPO anticipated this year, the vast majority of this video is relevant to your situation.

The “12-Month SpaceX Checklist” (save this)

If you want a quick sanity checklist:

Tender Decision

What % of my net worth is SpaceX?

Do I need cash in the next 12–18 months?

Can I tolerate no liquidity until after a lockup?

Share Selection (if Selling)

Am I avoiding ISO disqualifying dispositions?

Am I avoiding short-term gains?

Am I selecting lots intentionally (basis, AMT recoup, holding periods)?

Exercising Options (or Not)

What’s my post-termination risk if I leave?

Do I have a funded plan for exercise + AMT?

If I exercise, what’s my AMT strategy and recoup plan?

IPO Readiness

Do I have a plan that assumes I cannot sell for a while?

Do I understand blackout periods and liquidity windows?

Concentration Risk + Tax Plan

What’s my “enough” number?

What is my 3-bucket selling plan?

What is my tax mitigation plan?

What rules stop me from making emotional decisions?

A quick note on the most common “quiet mistake”

In my experience advising employees on a total of more than half a billion of equity comp, the biggest error I see is doing nothing (assuming everything will turn out OK). And in situations like SpaceX where the stock has done nothing but go up, doing nothing turned out pretty great — so it can feel like a strong strategy. But life happens, and with an upcoming IPO things can change fast.

It's your money, and your decision. But 9 out of 10 times — the happier individual is the one who developed a plan for it vs. winging it.

The point of planning is not to predict the future. It’s to avoid being surprised by it.

If you want help: here’s what I’d do with you

If you’re a SpaceX employee navigating these decisions, this is the sequence I typically run:

Understand your goals (where are you trying to get to; what's important to you)

Map your equity inventory (RSUs / ISOs / NSOs / ESPP, holding periods, AMT history)

Stress-test concentration risk cross referenced with single company investment risk and your financial goals

Build a rules-based 12–24 month plan

Then tax-optimize the implementation (reduce/avoid capital gains, recoup AMT, and more)

And of course everything else too (savings rate, retirement readiness, insurance coverage, children’s education, home purchase plans) — but we prioritize by importance and urgency. And there’s a lot of exciting things happening at SpaceX right now 😃

If that’s useful, you can book a quick intro call (a booking line is in my profile here)

Article Last Updated: January 15, 2026