The IPO Millionaire’s 180 Day Lockup Playbook

The 2025 IPO resurgence has finally arrived after 3+ years of tepid IPO activity. If your company is one of the dozens of exciting IPOs that have occurred year to date (or will soon be one); first and foremost congrats!

And IPO changes a lot; with liquidity now available after years of waiting. But, sitting on newly public stock your prohibited from selling for 90-180 days (lockup period), has a mix of excitement and anxiety watching the daily price swings.

Here's the good news: your lockup period isn't a waiting game—you can turn it into a strategic advantage if you use the time to develop a rock-solid plan. Check out our comprehensive 45 minute video where we dive into exactly what you should be focused on right now to optimize your financial future (or if you're more of a reader, there's an article recap below).

The Three-Priority Framework

Priority #1: Know Where You're Going

If you’ve read any of my other articles, you’ve probably seen (maybe more than once) how adamant I am about creating a financial plan. Here’s a brief run through - check out this article for more detailed advice on creating a plan. But at a high level, what you want to focus on is:

Map your current situation: Calculate your complete financial picture (equity comp, income, assets, debts, etc). Most people are surprised by what they discover when they see everything laid out.

Define your goals clearly: What do you actually want this wealth to do for you (eg early retirement, new home)? Be specific about timelines and dollar amounts.

Create and implement your comprehensive plan: This means developing strategies across 10+ key categories like investment management, retirement planning, cash flow planning, and many more.

Two planning areas require particular expertise: equity compensation strategy and tax optimization. Extensive knowledge here can make the difference between preserving wealth versus making costly mistakes. At 30/40 Wealth, we specialize in helping tech professionals navigate the complexity of these vectors (along with all other facets of financial planning).

Priority #2: Create Your Stock Strategy (Don't Avoid the Situation)

"I didn't know what to do... so I didn't do anything" is the most common regret we hear from prospective clients. Here's how to think about your situation strategically and create a plan that works for you.

Overcome your brain's biases. You're probably keeping too much company stock because of inertia (easier to do nothing), insider bias, and tax aversion. Check out this article to learn more about the psychology behind these types of financial decisions.

Face the data: 70%+ of companies underperform the market post-IPO. Individual stocks significantly underperform diversified portfolios over time. Your company may be different, but the odds aren't in your favor.

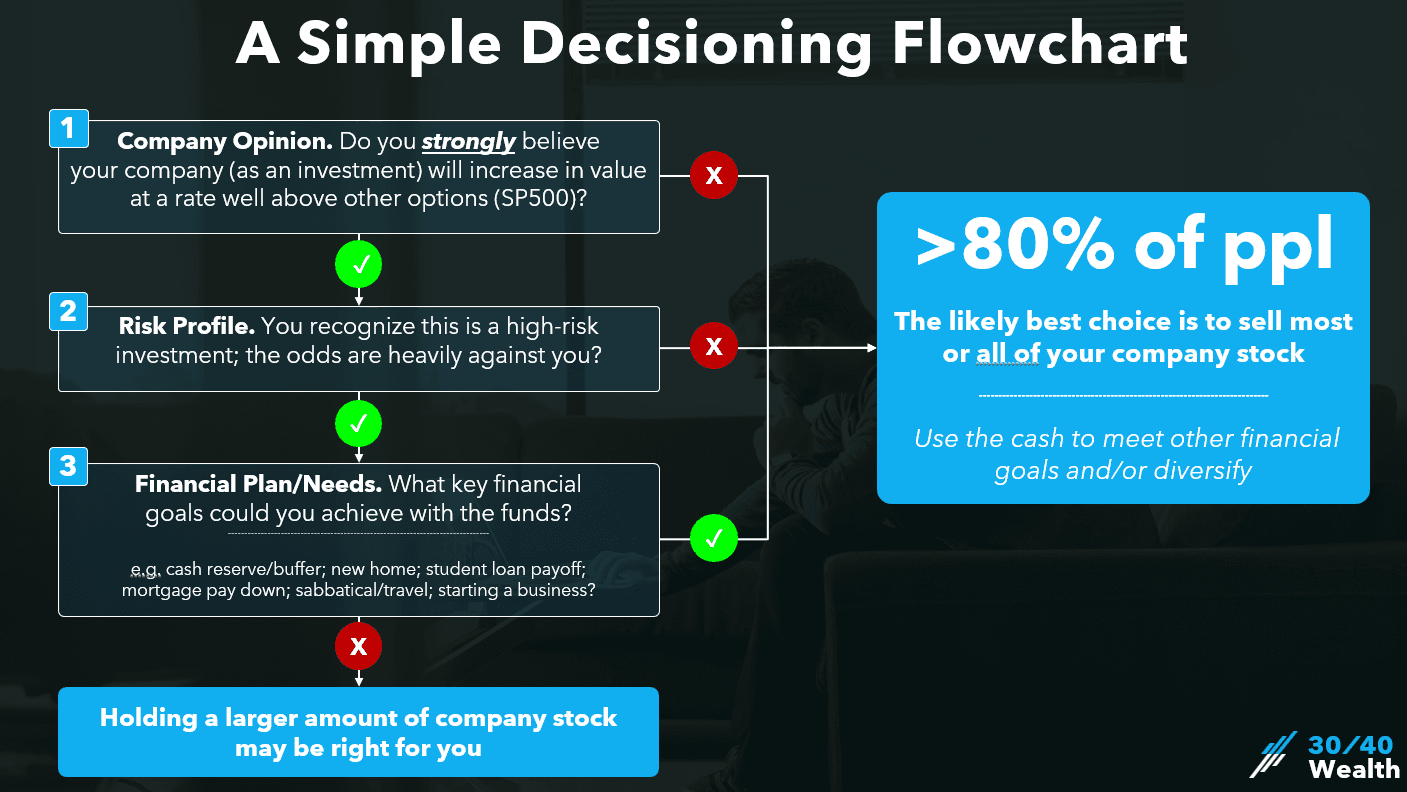

Use this decision tree to determine how much stock to keep:

Here's a helpful mental exercise using the regret minimization framework. What would you regret more:

selling stock that later increases significantly, or

not selling stock that later declines significantly?

Create a three-part plan:

Sell some stock immediately when lockup expires. Make this decision based on money you've "invested," your risk profile, near-term and long-term financial needs, and your company outlook including downside risk.

Sell systematically over time using selling schedules (fixed shares every X months or dollar targeting) and/or target prices at specific price points.

Keep some long-term if desired (typically 0-20% of holdings). If keeping a significant amount, make sure to write down your investment thesis (why you believe the company will outperform, and what needs to happen to prove you right or wrong), and define specific exit plans for BOTH success and failure scenarios.

For more in-depth information on creating a selling plan, check out this article.

Priority #3: Tax Optimization

Smart tax planning can boost your wealth by 3-8%, sometimes more than 20% in unique situations. However, you'll encounter 13 different types of taxes and 50+ potential equity compensation tax strategies.

Note: remember that tax strategies should support your financial goals and investment strategy, not drive them.

Income Tax Strategies:

Maximize deductions in high-income years (401k, HSA/FSA, charitable donations) when your marginal rate jumps to 32%+ during RSU vesting

ISO/AMT management to exercise ISOs without triggering AMT bills, and recoup previous AMT credits through stock sales

Strategic NSO exercise timing to manage tax brackets each year rather than taking large income hits

Uncommon strategies where specialized investments generate losses, offsetting W-2 income while creating deferred capital gains (eg select hedge funds, short-term rental properties)

Hybrid Income and Capital Gains Strategies:

State relocation to low/no tax states to avoid state taxes on capital gains and future income

Charitable giving through Donor Advised Funds to avoid capital gains tax while providing full income deductions

Charitable trusts (CRUT/CRAT) for immediate diversification without taxes, while providing income over time and upfront deductions

Capital Gains Tax Strategies:

Tax lot management and timing to choose which specific lots to sell - and time sales for lower-bracket years

Tax loss harvesting to pair gains with losses, especially using Direct Indexing which generates losses

Accelerated tax loss harvesting (130/30 strategies) using leverage and short-selling to generate more losses faster

Exchange funds to pool your stock with 20+ other companies for instant diversification without taxes

351 exchanges to trade semi-diversified portfolios for ETFs with the same cost basis

Hedging strategies to lock in price ranges for 1-3 years without initial costs, buying time for other strategies

Opportunity zones (starting 2027) to defer gains for 5 years with potential tax-free growth if held 10+ years

Many of these strategies are complex with specific timing requirements. Working with professionals who specialize in equity compensation tax planning helps navigate the 50+ available strategies.

Making the Most of Your Opportunity

Your lockup period provides a valuable opportunity to make thoughtful decisions instead of reactive ones. Work on your plan - the good news is that having even part of a plan is infinitely better than having no plan. When your lockup expires, you'll be ready to execute with confidence rather than panic.

Article Last Updated: September 17, 2025